Selina Concise Mathematics Class 10 ICSE Solutions Value Added Tax

Selina ICSE Solutions for Class 10 Maths Chapter 1 Value Added Tax

Exercise 1(A)Question 1.

Rajat purchases a wrist-watch costing ₹ 540. The rate of sales tax is 8%. Find the total amount paid by Rajat for the watch.

Solution:

Sale price of watch = ₹ 540

Rate of sales tax = 8%

Total amount paid by Rajat = ₹ 540 + 8% of ₹ 540

= ₹ 540 + ₹ 43.20

= ₹ 583.20

Ramesh paid ₹ 345.60 as sales tax on a purchase of ₹ 3,840. Find the rate of sales tax.

Solution:

Sale price = ₹ 3,840

Sales tax paid = ₹ 345.60

Question 3.

The price of a washing machine, inclusive of sales tax is ₹ 13,530/-. If the sales tax is 10%, find its basic cost price.

Solution:

Selling price of washing machine = ₹ 13,530

Rate of sales tax = 7%

Question 4.

Sarita purchases biscuits costing ₹ 158 on which the rate of sales tax is 6%. She also purchases some cosmetic goods costing ₹ 354 on which the rate of sales tax is 9%. Find the total amount to be paid by Sarita.

Solution:

Sale price of biscuits = ₹ 158

Rate of sales tax on biscuits= 6%

Amount paid for biscuits= ₹ 158 + 6% of ₹ 158

= ₹ 158 + ₹ 9.48

= ₹ 167.48

Sale price of cosmetic goods = ₹ 354

Rate of sales tax= 9%

Amount paid for cosmetic goods = ₹ 354 + 9% of ₹ 354

= ₹ 354 + ₹ 31.86

= ₹ 385.86

Total amount paid by Sarita = ₹ 167.48 + ₹ 385.86

= ₹ 553.34

The marked price of two articles A and B together is ₹ 6,000. The sales tax on article A is 8% and that on article B is 10%. If on selling both the articles, the total sales tax collected is ₹ 552, find the marked price of collected of the articles A and B.

Solution:

Let the marked price of article A be ₹ x and article B be ₹ y.

The marked price of A and B together is ₹ 6,000.

⇒ x + y = 6,000 ……..(i)

The sales tax on article A is 8% and that on article B is 10%.

Also the total sales tax collected on selling both the articles is ₹ 552.

⇒ 8% of x + 10% of y = 552

⇒ 8x + 10y = 55,200 ……..(ii)

Multiply equation (i) by 8 and subtract it from equation (ii) we get,

2y = 7,200

⇒ y =3,600

Substituting y = 3,600 in equation (i) we get,

x + 3,600 = 6,000

⇒ x = 2,400

The marked price of article A is ₹ 2,400 and article B is ₹ 3,600.

The price of a T.V. set inclusive of sales tax of 9% is ₹ 13,407. Find its marked price. If sales tax is increased to 13%, how much more does the customer has to pay for the T.V.?

Solution:

(i) Total price paid for T.V. = ₹ 13,407

Rate of sales tax = 9%

Let sale price = ₹ y

According to question

New rate of sales tax = 13%

New total price for T.V. = ₹ 12,300+ 13% of ₹ 12,300

= ₹ 12,300 + ₹ 1,599

= ₹ 13,899

More money paid = ₹ 13,899 – ₹ 13,407 = ₹ 492

The price of an article is ₹ 8,250 which includes sales tax at 10%. Find how much more or less does a customer pay for the article, if the sales tax on the article:

(i) increases to 15%

(ii) decreases to 6%

(iii) increases by 2%

(iv) decreases by 3%

Solution:

Let sale price of article = ₹ y

Total price inclusive of sales tax = ₹ 8,250

Rate of sales tax = 10%

According to question

(i) New rate of sales tax = 15%

New total price = ₹ 7,500 + 15% of ₹ 7,500

= ₹ 7,500 + ₹ 1,125 = ₹ 8,625

More money paid = ₹ 8,625 – ₹ 8,250 = ₹ 375

(ii) New rate of sales tax = 6%

New total price = ₹ 7,500 + 6% of ₹ 7,500

= ₹ 7,500 +₹ 450 = ₹ 7,950

Less money paid = ₹ 8,250 – ₹ 7,950 = ₹ 300

(iii) New rate of sales tax = (10+2)% = 12%

New total price = ₹ 7,500 + 12% of ₹ 7,500

= ₹ 7,500+ ₹ 900 = ₹ 8,400

More money paid = ₹ 8,400 – ₹ 8,250 = ₹ 150

(iv) New rate of sales tax =(10-3)%= 7%

New total price = ₹ 7,500+ 7% of ₹ 7,500

= ₹ 7,500 + ₹ 525 = ₹ 8,025

Less money paid = ₹ 8,250 – ₹ 8,025 = ₹ 225

A bicycle is available for ₹ 1,664 including sales tax. If the list price of the bicycle is ₹ 1,600, find :

(i) the rate of sales tax.

(ii) the price, a customer will pay for the bicycle if the sales tax is increased by 6%.

Solution:

Price of bicycle inclusive of sales tax = ₹ 1,664

List price of bicycle = ₹ 1,600

(i) Sales tax= ₹ 1,664 – ₹ 1,600 = ₹ 64

New total price = ₹ 1,600+ 10% of ₹ 1,600

= ₹ 1,600 + ₹ 160

= ₹ 1,760

When the rate of sale-tax is decreased from 9% to 6% for a coloured T.V.; Mrs. Geeta will save ₹ 780 in buying this T.V. Find the list price of the T.V.

Solution:

Question 10.

A trader buys an unfinished article for ₹ 1,800 and spends ₹ 600 on its finishing, packing, transportation, etc. He marks the article at such a price that will give him 20% profit. How much will a customer pay for the article including 12% sales tax.

Solution:

Purchase price = ₹ 1,800

Expenditure = ₹ 600

Total price = ₹ 1,800+ ₹ 600 = ₹ 2,400

M.P. of article = ₹ 2,400 + 20% of ₹ 2400

= ₹ 2,400 + ₹ 480 = ₹ 2,880

Cost price for customer = ₹ 2,880+ 12% of ₹ 2,880

= ₹ 2,880 + ₹ 345.60

= ₹ 3,225.60

A shopkeeper buys an article for ₹ 800 and spends ₹ 100 on its transportation, etc. He marks the article at a certain price and then sells it for ₹ 1,287 including 10% sales tax. Find his profit as percent.

Solution:

C.P. of an article = ₹ 800

Expenditure = ₹ 100

Total C.P. = ₹ 800 + ₹ 100 = ₹ 900

Let sale price = ₹ y

Sale price inclusive of sales tax = ₹ 1,287

Rate of sales tax = 10%

Then y + 10% of y = ₹ 1,287

Question 12.

A shopkeeper announces a discount of 15% on his goods. If the marked price of an article, in his shop, is ₹ 6,000; how much a customer has to pay for it, if the rate of sales tax is 10%?

Solution:

Marked price of article = ₹ 6,000

Sale price after discount = ₹ 6,000 – 15% of ₹ 6,000

= ₹ 6,000 – ₹ 900

₹ 5,100

Rate of sales tax = 10%

Cost price for customer = ₹ 5,100 + 10% of ₹ 5,100

= ₹ 5,100+ ₹ 510

= ₹ 5,610

The catalogue price of a colour T.V. is ₹ 24,000. The shopkeeper gives a discount of 8% on the list price. He gives a further off season discount of 5% on the balance. But sales tax at 10% is charged on the remaining amount. Find :

(a) the sales tax a customer has to pay.

(b) the final price he has to pay for the T.V

Solution:

Exercise 1(B)

Question 1.

A shopkeeper purchases an article for ₹ 6,200 and sells it to a customer for ₹ 8,500. If the sales tax (under VAT) is 8%; find the VAT paid by the shopkeeper.

Solution:

Purchase price for shopkeeper = ₹ 6,200

Sale price for shopkeeper = ₹ 8,500

Tax paid by the shopkeeper = 8% of 6,200 = ₹ 496

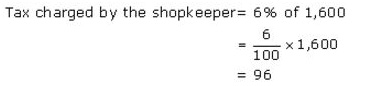

Tax charged by the shopkeeper= 8% of 8,500

Then VAT paid by the shopkeeper= ₹ 680 – ₹ 496 = ₹ 184

A purchases an article for ₹ 3,600 and sells it to B for ₹ 4,800. B, in turn, sells the article to C for ₹ 5,500. If the sales tax(under VAT) is 10%, find the VAT levied on A and B.

Solution:

Purchase price for A = ₹ 3,600

Tax paid by A = 10% of ₹ 3,600

Purchase price for B = ₹ 4,800

Tax paid by B to A = 10% of ₹ 4,800

Purchase price for C = ₹ 5,500

Tax paid by C to B = 10% of ₹ 5,500

VAT paid by A = ₹ 480 – ₹ 360 = ₹ 120

VAT paid by B = ₹ 550 – ₹ 480 = ₹ 70

A manufacturer buys raw material for ₹ 60,000 and pays 4% tax. He sells the ready stock for ₹ 92,000 and charges 12.5% tax. Find the VAT paid by the manufacturer.

Solution:

Purchase price for manufacture = ₹ 60,000

Tax paid by manufacturer = 4% of ₹ 60,000

Sale price for manufacturer = ₹ 92,000

Tax charged by manufacturer = 12.5% of ₹ 92,000

VAT paid by manufacturer = ₹ 11,500 – ₹ 2,400

= ₹ 9,100

The cost of an article is ₹ 6,000 to a distributor. He sells it to a trader for ₹ 7,500 and the trader sells it to a customer for ₹ 8,000. If the VAT rate is 12.5%; find the VAT paid by the :

(i)distributor

(ii)trader.

Solution:

Cost price for distributor = ₹ 6,000

Tax paid by distributor = 12.5% of ₹ 6,000

Sale price for distributor= ₹ 7,500

Tax charged by distributor= 12.5% of ₹ 7,500

VAT paid by distributor = ₹ 937.50 – ₹ 750

= ₹ 187.50

Sale price for trader = ₹ 8,000

Tax charged by trader = 12.5% of ₹ 8,000

VAT paid by trader= ₹ 1,000 – ₹ 937.50 = ₹ 62.50

The printed price of an article is ₹ 2,500. A wholesaler sells it to a retailer at 20% discount and charges sales tax at the rate of 10%. Now the retailer, in turn, sells the article to a customer at its list price and charges the sales tax at the same rate. Find :

(i) the amount that retailer pays to the wholesaler.

(ii) the VAT paid by the retailer.

Solution:

Question 6.

A retailer buys an article for ₹ 800 and pays the sales tax at the rate of 8%. The retailer sells the same article to a customer for ₹ 1,000 and charges sales tax at the same rate. Find:

(i) the price paid by a customer to buy this article.

(ii) the amount of VAT paid by the retailer.

Solution:

Cost price for retailer = ₹ 800

Sales tax paid by retailer = 8% of ₹ 800

Sale price for retailer = ₹ 1,000

Tax charged by retailer = 8% of ₹ 1,000

Price paid by customer = ₹ 1,000 + ₹ 80 = ₹ 1,080

VAT paid by retailer = ₹ 80 – ₹ 64 = ₹ 16

A shopkeeper buys 15 identical articles for ₹ 840 and pays sales tax at the rate of 8%. He sells 6 of these articles at ₹ 65 each and charges sales tax at the same rate. Calculate the VAT paid by the shopkeeper against the sale of these six articles.

Solution:

Question 8.

The marked price of an article is ₹ 900 and the rate of sales tax on it is 6%. If on selling the article at its marked price, a retailer has to pay VAT = ₹ 4.80; find the money paid by him (including sales tax) for purchasing this article.

Solution:

Question 9.

A manufacturer marks an article at ₹ 5,000. He sells this article to a wholesaler at a discount of 25% on the marked price and the wholesaler sells it to a retailer at a discount of 15% on its marked price. If the retailer sells the article without any discount and at each stage the sales tax is 8%, calculate the amount of VAT paid by :

(i) the wholesaler (ii) the retailer

Solution:

Question 10.

A shopkeeper buys an article at a discount of 30% and pays sales tax at the rate of 8%. The shopkeeper, in turn, sells the article to a customer at the printed price and charges sales tax at the same rate. If the printed price of the article is ₹ 2,500; find :

(i) the price paid by the shopkeeper.

(ii) the price paid by the customer.

(iii) the VAT (value added tax) paid by the shopkeeper.

Solution:

Question 11.

A shopkeeper sells an article at its list price (₹ 3,000) and charges sales tax at the rate of 12%. If the VAT paid by the shopkeeper is ₹ 72, at what price did the shopkeeper buy the article inclusive of sales tax?

Solution:

Question 12.

A manufacturer marks an article for ₹ 10,000. He sells it to a wholesaler at 40% discount. The wholesaler sells this article to a retailer at a discount of 20% on the marked price. If retailer sells the article to a customer at 10% discount and the rate of sales tax is 12% at each stage; find the amount of VAT paid by the (i) wholesaler (ii) retailer.

Solution:

VAT paid by wholesaler = ₹ 960 – ₹ 720= ₹ 240

VAT paid by retailer = ₹ 1080 – ₹ 960= ₹ 120

Question 1.

Madan purchases a compact computer system for ₹ 47,700 which includes 10% rebate on the marked price and then a 6% sales tax on the remaining price. Find the marked price of the computer.

Solution:

Question 2.

An article is marked at ₹ 500. The wholesaler sells it to a retailer at 20% discount and charges sales tax on the remaining price at 12.5%. The retailer, in turn, sells the article to a customer at its marked price and charges sales tax at the same rate. Calculate:

(i) The price paid by the customer.

(ii) The VAT paid by the retailer.

Solution:Question 3.

An article is marked at ₹ 4,500 and the rate of sales tax on it is 6%. A trader buys this article at some discount and sells it to a customer at the marked price. If the trader pays ₹ 81 as VAT; find:

How much per cent discount does the trader get?

The total money paid by the trader, including tax, to buy the article.

Solution:

Question 4.

A retailer sells an article for ₹ 5,350 including 7% sales tax on the listed price. If he bought it at a discount and has made a profit of 25% on the whole, find the rate of discount the retailer received.

Solution:

Question 5.

A shopkeeper buys a camera at a discount of 20% from the wholesaler, the printed price of the camera being ₹ 1,600 and the rate of sales tax being 6%. The shopkeeper sells it to a buyer at the printed price and charges tax at the same rate. Find:

The price at which the camera can be bought from the shopkeeper.

The VAT (Value Added Tax) paid by the shopkeeper.

Solution:

Printed price of camera = ₹ 1,600

Discount% = 20%

Purchase price for the shopkeeper

= ₹ 1,280 + ₹ 76.80 = ₹ 1,356.80

Selling price for the shopkeeper = ₹ 1,600

Purchase price for a customer = ₹ 1,600 + ₹ 96 = ₹ 1,696

The price at which the camera can be bought from the shopkeeper is ₹ 1,696.

VAT paid by the shopkeeper= Tax charged – Tax paid

= ₹ 96 – ₹ 76.80 = ₹ 19.20

The VAT (Value Added Tax) paid by the shopkeeper is ₹ 19.20.

Tarun bought an article for ₹ 8,000 and spent ₹ 1,000 on its transportation. He marked the article at ₹ 11,700 and sold it to a customer. If the customer had to pay 10% sales tax, find:

(i) The customer’s price (ii) Tarun’s profit percent.

Solution:

Purchase price for = ₹ 8,000

Expense on transportation = ₹ 1,000

Cost price for Tarun = ₹ 8,000 + ₹ 1,000 = ₹ 9,000

Marked price by Tarun = ₹ 11,700

Question 7.

A shopkeeper sells an article at the listed price of ₹ 1,500 and the rate of VAT is 12% at each stage of sale. If the shopkeeper pays a VAT of ₹ 36 to the Government, what was the price, inclusive of Tax, at which the shopkeeper purchased the article from the wholesaler?

Solution:

Question 8.

A shopkeeper bought a washing machine at a discount of 20% from a wholesaler, the printed price of the washing machine being ₹ 18,000. The shopkeeper sells it to a consumer at a discount of 10% on the printed price. If the rate of VAT (or sales tax) is 8%, find :

(i) The VAT paid by the shopkeeper.

(ii) The total amount that the consumer pays for the washing machine.

Solution:

Question 9.

Mohit, a dealer in electronic goods, buys a high class TV set for ₹ 61,200. He sells this TV set to Geeta, Geeta to Rohan and Rohan sells it to Manoj. If the profit at each stage is ₹ 2,000 and the rate of VAT at each stage is 12.5%, find:

(i) total amount of tax (under VAT) paid to the Government.

(ii) Money paid by Manoj to buy the TV set.

Solution:

Question 10.

A shopkeeper buys an article at a discount of 30% of the list price which is ₹ 48,000. In turn, the shopkeeper sells the article at 10% discount. If the rate of VAT is 10%, find the VAT to be paid by the shopkeeper.

Solution:

Question 11.

A company sells an article to a dealer for 40,500 including VAT (sales-tax). The dealer sells it to some other dealer for 42,500 plus tax. The second dealer sells it to a customer at a profit of 3,000. If the rate of sales-tax under VAT is 8%, find :

(i) The cost of the article (excluding tax) to the first dealer.

(ii) The total tax (under VAT) received by the Government.

(iii) The amount that a customer pays for the article.

Solution:

Question 12.

A wholesaler buys a TV from the manufacturer for ₹ 25,000. He marks the price of the TV 20% above his cost price and sells it to a retailer at 10% discount on the marked price. If the rate of VAT is 8%, find the :

(i) Marked price.

(ii) Reailer’s cost price inclusive of tax.

(iii) VAT paid by the wholesaler.

Solution: